So taxes hurt really bad this year(Big league! Bigly?). While we don’t mind paying our share of taxes and we want to contribute to our already great nation and state, the frustrating thing is that the general guidance offered by the W-4 becomes inaccurate as you become married and your income is over a certain threshold.

My main advice is if any of you out there land a new job, get that great promotion or finish school and commence your career in a well paying field, do the following. Find out how much you should really owe by getting an accountant, using an online tax estimator’s service or try slogging through the IRS’ 2017 withholding calculator(Free, but painful).

https://apps.irs.gov/app/withholdingcalculator/

Observe how much taxes are actually coming out of your check, do the math to see if it’ll actually be what should be withheld. Then go back and update your W-4 form until it aligns to the correct amount.

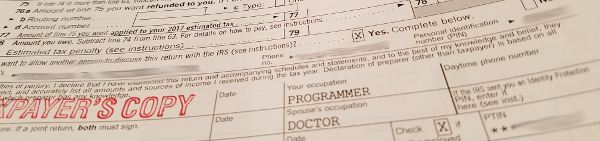

In our 2016 story, I relied on the good ole W-4 form and filed “Single with one allowance” while Diana filed “Married with 3 allowances”. Now this form instructs you to mark one for yourself, so I believed I was personally filing only for me while Diana would be filing what should be the norm so that we would hopefully get a tiny bit back.

Unfortunately, I could not be more wrong. We’ve hit various triggers due to our income, where many deductions no longer apply due to this rule called the “Alternative minimum tax”. In the years before it marginally hit us, so little things could not be deducted. Now, we’re past some magic hump where we yield no benefits for having children and it’s almost not even worth documenting that they’re our dependents. So this year we were hit with a massive payment amount.

After meeting with our accountant, he calculated out our 2017 numbers and we’re now both filing “Single with zero allowances” and also withholding extra to hopefully not owe anything next year.

I hope that before this happens to others, that us sharing this experiences can prevent anyone else the shock, stress and pain from dealing with the egregious inaccuracies of the W-4. I also look forward to the IRS team members who fixes the formula behind the W-4, so that the process is simple and accurate.

Make more money, pay more taxes. Repeat and enjoy…. 🙂